Suppose you have arrived at a point in your life where managing your properties has become tedious and is no longer fun like it used to be. Now a thought comes to your mind that you’d like to trade your property for shares in a Real Estate Investment Trust (REIT).

Unfortunately, this isn’t possible. This is because REIT shares do not basically qualify for 1031 exchanges as they’re not regarded as personal property by the IRS. IRS Section 1031 stipulates that only like-kind properties can qualify for 1031 Exchange.

Here is what you must know about exchanging your property into REIT shares.

What does 1031 Exchange mean?

Commonly known as a like-kind exchange, 1031 Exchange refers to a specialized form of real estate transaction that allows any interested investor to defer capital gains taxes after a sale of an investment property as long as they exchange the proceeds of the sale with another replacement property that is termed like-kind.

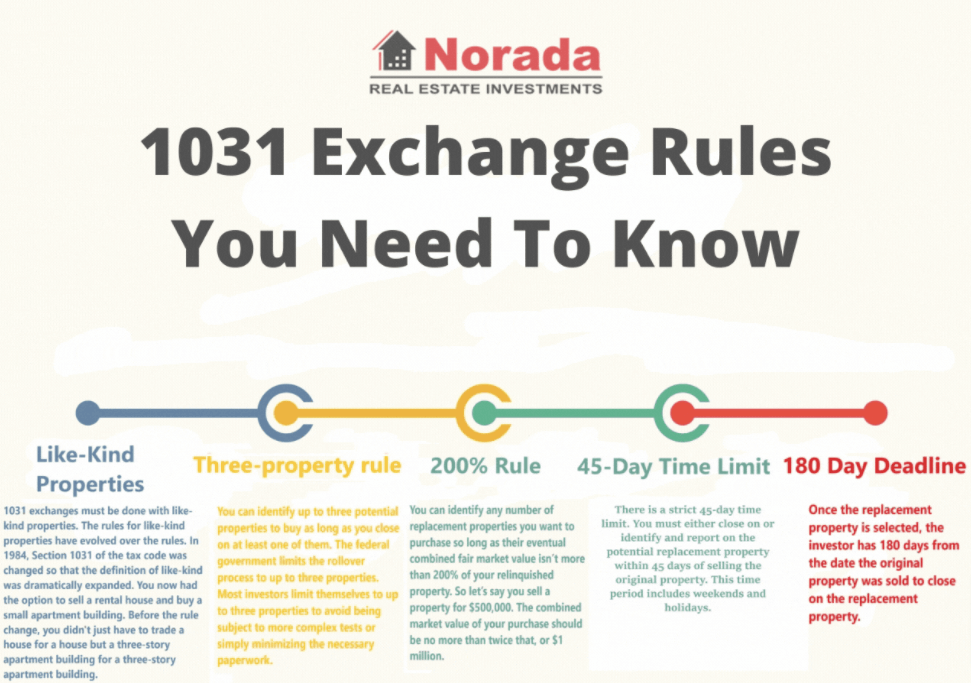

In order to complete the 1031 exchange successfully, two rules must be followed. The first rule states that the replacement property must be like-kind to the relinquished one. This means that both properties should be of the same nature and character.

Most of the real estate properties are considered like-kind to other real estate provided that both properties are situated in the United States and are meant for productive use either in a trade or investment. For example, a warehouse is considered like-kind to a retail shopping center.

The second rule states that you should identify the replacement property for exchange within 45 days after selling the relinquished property. Also, this transaction should be completed within 180 days. If the replacement property isn’t found within the time limit, the whole transaction can become taxable.

What is REIT?

Real Estate Investment Trust (REIT) basically refers to a specialized investment model that offers investors exposure to commercial real estate assets without undergoing the hassle of owning them.

It’s very important to note that the shares in REITs can be publicly traded, just like bonds, mutual funds, or even stocks. The main purpose of investing in REITs is to provide investors with a high degree of liquidity that isn’t particularly involved in real estate.

Also, it might interest you to know that the shares in REITs can also be privately traded, meaning that they’re only available to a group of accredited investors who meet a certain threshold as far as income and net worth are concerned.

Investing in REIT means that you’ll be buying shares in a company that owns real estate assets. This is something that entitles you to a portion of the cash flow and profits realized by the underlying assets.

Can you complete a 1031 Exchange into a REIT?

The simple answer is no. It is not possible to complete a 1031 exchange into REIT. This is because, as per the 1031 Exchange rules, this type of transaction must involve real property, which should be the tangible and physical structure of real estate.

Since REIT involves shares, they’re not recognized by the IRS as like-kind to physical real estate assets. However, there is an alternative that you can use, and it involves using the sale proceeds of the relinquished property’s sale to invest in a special kind of REIT known as UPREIT.

UPREIT, which is an acronym for Umbrella Partnership Real Estate Investment Trust, provides investors with an alternative solution when it comes to exchanging their property sale proceeds with REIT shares.

In a UPREIT, the physical real estate properties are mainly owned by an Operating Partnership (OP) in which the REIT is the general partner and also owns the majority of the OPs. In order to defer capital gains, you’ll have to contribute your property to the Operating Partnership for you to get OP units.

So, in the end, you don’t own REIT shares, but rather, you own units in the Operating Partnership which basically owns the real estate properties.

Summing up

Navigating through 1031 Exchanges can be a very complicated task, especially if it’s your first time attempting such a transaction. For this reason, it is best to consult your CPA, tax advisor, and attorney before embarking on such a process.